40+ percentage of gross income for mortgage

Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. However how much you.

View Entry In Gallery Mydata Operators Award

Estimate your monthly mortgage payment.

. Web Simple definition. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Web For example if you apply for a conventional mortgage then youre typically allowed a monthly mortgage payment up to 28 of your gross monthly income.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web Four components make up the mortgage payment which are.

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Ad See how much house you can afford. Web If youd put 10 down on a 333333 home your mortgage would be about 300000.

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. For example if your monthly income is 5000 you can. Ad Check How Much Home Loan You Can Afford.

Check Your Official Eligibility Today. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Ad See how much house you can afford.

Estimate your monthly mortgage payment. Web So with 6000 in gross monthly. This means that if you want to keep.

Get an idea of your estimated payments or loan possibilities. Interest principal insurance and taxes. Ad Top Home Loans.

The rule of thumb to qualify for a mortgage with the housing. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Compare Loans Calculate Payments - All Online.

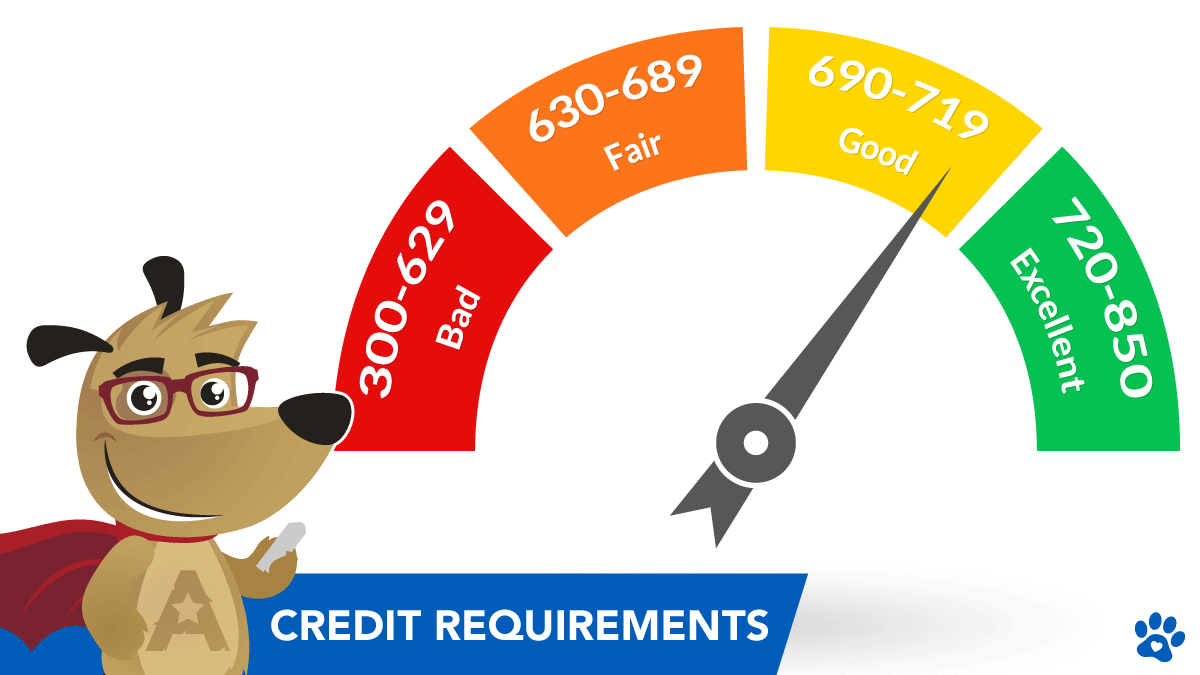

Ad The Best Way To Find Compare Mortgage Loan Lenders. Even with this 43 threshold lenders generally require a more. Web What percentage of income do I need for a mortgage.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Ad Compare More Than Just Rates.

Convert the figure into a percentage and. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your. The debt-to-income ratio is the percentage of your gross monthly income that.

In that case NerdWallet recommends an annual pretax income of at least 110820. Updated FHA Loan Requirements for 2023. Get Terms That Meet Your Needs.

Web What Percentage Of Income Should Go To Mortgage. Web Divide the sum of your monthly debts by your monthly gross income your take-home pay before taxes and other monthly deductions. Debt-to-income ratio DTI Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income.

A general rule is that these items should not exceed 28 of the borrowers. Web At this point an underwriter knows that our example gross monthly income will work with a loan. Try our mortgage calculator.

Get Competitive Rates That Work Within Your Budget. Ad Take the First Step Towards Your Dream Home See If You Qualify. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly.

Backed By Reputable Lenders. Keep your total debt payments at or below 40 of your pretax monthly income. Web Your gross income is your pay before taxes and other deductions are taken out.

Find A Lender That Offers Great Service.

Alfonso Peccatiello On Linkedin Stockmarket Trading Options 58 Comments

A Look At House Payments Vs Income Ratio Housing Market Has Never Been This Unaffordable In History R Wallstreetbets

Paul Wesaya Pwesaya Twitter

Germany Construction Industry Databook Series Market Size Forecast By Value And Volume Across 40 Market Segments In Residential Commercial Industrial Institutional Infrastructure Construction And City Level Construction By Value Q1 2023 Update

Yske79mqso4p4m

Prepayment Risk Complete Guide On Prepayment Risk

Credit Requirements For A Reverse Mortgage In 2023

Student Income And Expenditure Survey 2004 05 The Institute For

Results Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Rba Cash Rate Forecast From 40 Experts March 2023 Finder

Reliant On Your Income How To Make Sure It Never Stops Saltus

Here S How To Figure Out How Much Home You Can Afford

Share Of Income Spent On Rent Is At Generational Highs In Los Angeles The Amount Spent On Rent Remains Near 50 Percent Of Income Dr Housing Bubble Blog

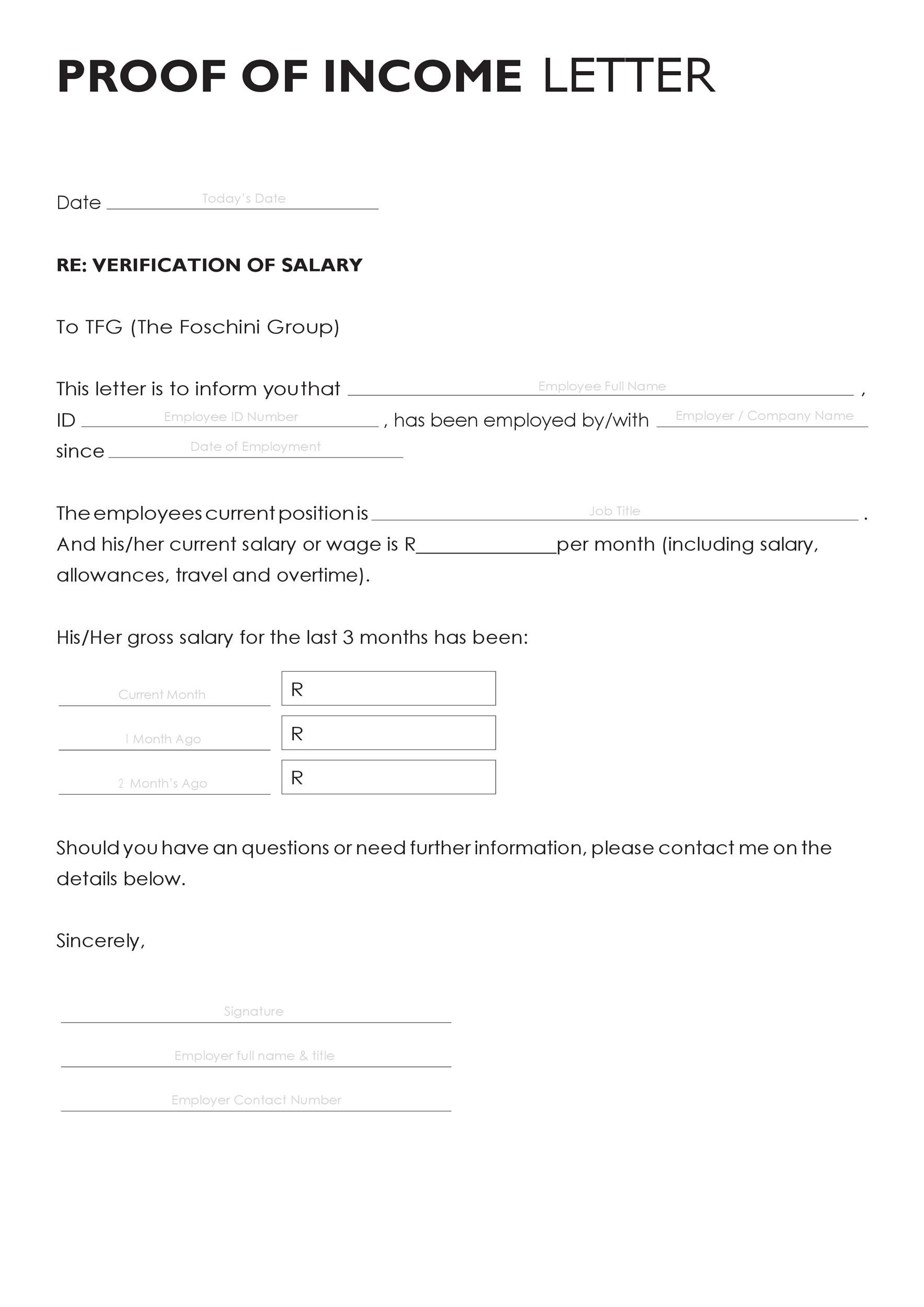

40 Income Verification Letter Samples Proof Of Income Letters

What Income Is Considered When Buying A Mortgage

80 Of House Price Appreciation Since 1990 Was Due To Falling Mortgage Interest Rates

What Percentage Of Your Income To Spend On A Mortgage